Ops Excellence Series: Lessons from Planning Processes at Uber

This series will deep-dive into lessons from managing Ops teams at high-growth startups.

I’ve been fortunate in my career to work cross-functionally at companies of all sizes. At Uber, my Product Operations team liaised with every major functional team, and at Fast, I led or co-led every function at some point. Over time, I’ve gained a passion for Operations and the underlying infrastructure behind how the highest-performing companies operate. In this series, I’ll share some of my personal lessons and learnings from other Ops Leaders in Silicon Valley and beyond.

[Note: all of these lessons are based on my personal experiences and not endorsed by the companies mentioned.]

The first topic I’ll dive into is Planning. I joke that when I was at Uber, I spent half of my time on Planning and the second half on Performance Reviews (or so it seemed). When you’re managing an on-demand marketplace in 70+ countries with teams in hundreds of offices, a lot of coordination and planning is required to make sure things work smoothly.

First, I’ll dive into some key learnings from Uber. Then in the next edition, I’ll dive into lessons from Fast and from high-growth startups I’m fortunate to partner with.

A Focus on Growth

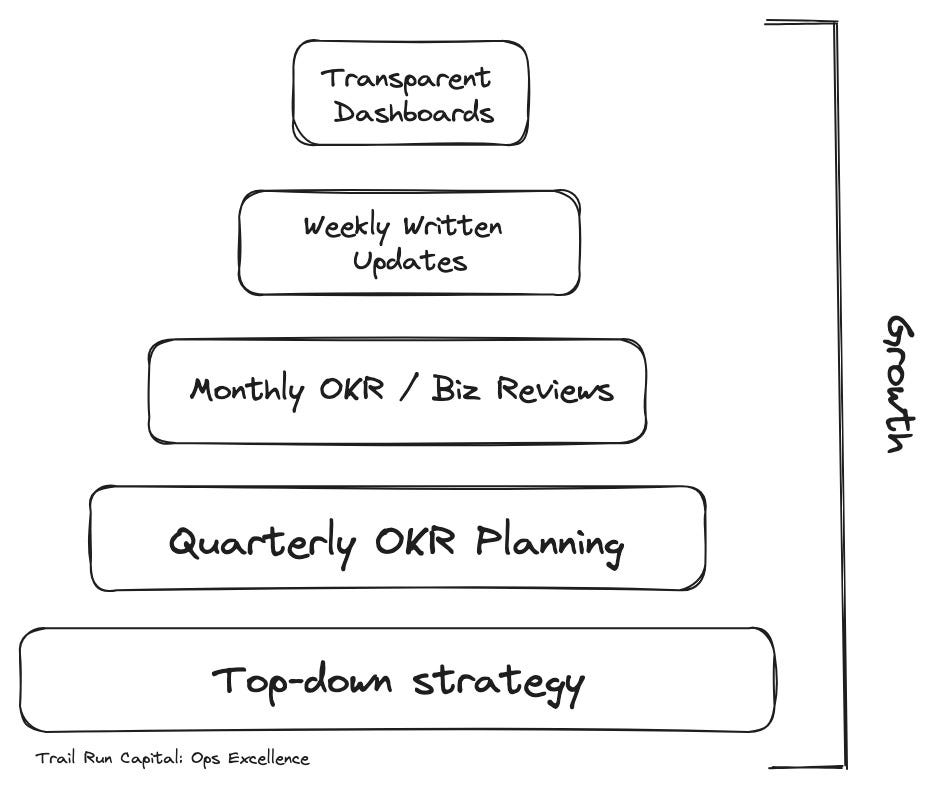

The overall theme of the Planning Pyramid is Growth. Though not intrinsic to every level of the pyramid, what makes a startup a startup (at least, for those who have a product to market) is growth. Therefore, growth should be one of the top KPIs of every post-product startup. This encompasses both revenue growth and general user growth.

Prior to Uber, I advised large health insurance companies on their tech strategies though PwC. While it was a valuable learning experience, the pace was a little slow, and I felt very disconnected with the end users.

When I started at Uber Chicago in 2014, our team was about 100 people. It was fun because of the impactful work that we were doing, the amazing people, and the huge community we were helping in Chicago. It was also fun because I’m a competitive person, and Uber was very focused on growing and winning the market. Everyone at Uber was exceptionally talented. We all went through a very rigorous and analytical interview process, and once you were within the company, you received a lot of autonomy and responsibility.

Uber had clear product-market fit so our focus was on execution. Each week at Global All Hands, TK (Travis Kalanick) and Ops Leaders would review our global trip growth rates (Week-over-Week) and talk about highlights, lowlights, and key projects and priorities. Even at scale, Uber was growing very quickly, and the entire company was aligned around continuing to grow.

While there can be cons to primarily focusing on growth, for early stage companies that have found product-market fit, I find that it’s highly motivating, inspirational and helps drive large outcomes.

One question that often comes up is, “When should you start focusing on growth?”

Generally, if the product is live, and there's a clear pull from the market, it’s never too early to focus on growth. Most scale-up companies don’t focus on growth enough, and it can really hurt them when raising their next funding round. If companies aren’t growing even though they are trying to, they need to spend more time with their customers and focus on quick product iteration, until they can start growing again. Raising capital is a false sense of achieving and reaching Product-Market Fit.

Growth is what creates the soul of any startup. If the focus on growth goes away, and the focus becomes ONLY on optimization or value extraction, then it’s no longer a startup. The upward equity potential is significantly minimized. Once the focus on growth goes away, then companies become far more political internally and top talent leaves. One reason that companies like Tesla and Nvidia continue to excel is that they are founder-led, and they’re primarily focused on product innovation, which leads to continued growth.

Top-Down Strategy

The foundation for any Planning process is a Top-Down Strategy. The strategy can vary in format and length. It could be a plan for 1 year or a plan for 5 years. The important thing is that it’s easy to understand and aligns the entire company in the same direction. If the top-down strategy is not clear, then teams will end up creating their own strategies. A few key features I find helpful:

Shorter is better: I prefer lengths around 1-3 pages so it’s easy for everyone to read and remember.

Aligned Exec Leadership: Whether the CEO, S&P team, Product leadership, or someone else writes the top-down strategy (ideally written by founder / CEO), there should be complete buy-in across the leadership team.

4-5 Key Categories: Uber would choose 4-5 ‘Big Rocks’ each year that were important focus areas for the company. They were easy to remember and emphasized over and over again.

Allow debate and feedback: Before the plan is finalized, leadership should be very open to debate about it and potentially collect feedback from sub-teams. Uber had a culture around ‘Toe-Stepping’ which meant that the right answer can come from anywhere. There are pros & cons to this, and the value has since been removed, however I do think it’s important to allow debates and not fall into a ‘Yes, Boss’ culture.

Quarterly OKRs

Once the top-down strategy is solidified, for most teams, I find that Quarterly OKRs are helpful to align teams and account for work. At Uber, Product teams would receive product requests from other cross-functional teams, from Ops, from Engineering, from other Product teams, etc. Then on a quarterly basis, the PMs would evaluate and stack rank the top priorities. Generally, there will be a mix of Growth, Reliability (including Bug Fixes), Compliance & Big-Bet projects.

I have created a very light-weight OKR template HERE that can easily be customized.

[Notes: 1) Quarterly OKRs will work better for scale-ups than for newer startups. Pre-PMF startups should likely lean on daily, bi-weekly or monthly goal setting. 2) I know there are MANY opinions on this topic and there are pros and cons to any planning process. Nvidia doesn’t even do yearly planning, and they’re doing okay so my process is not the only answer.]

Monthly OKR & Business Reviews

On a monthly basis, it’s a great best practice to run Monthly OKR or Business Reviews. In addition to reviewing status updates, leaders should be sure to ‘gut-check’ their teams’ projects or OKRs and make sure they still make sense for where the company needs to go. One reason that bigger companies can be slow to change is they spend a lot of time on planning, and it can be a lot of work to change the plans and stop a moving truck. Planning can be a helpful exercise to align everyone, and you don’t want to get so stuck on the plans that you can’t see the forest through the trees.

Weekly Metrics Reviews & Written Status Reporting

The Uber Chicago office consisted of Driver Operations teams, Marketing teams, and Customer Support teams. These teams would primarily report to City or Regional General Managers who managed the P&L for the local businesses.

Each week, teams (and often sub-teams) would do a team meeting to review all of the metrics for the previous week. This was helpful for keeping everyone on the same page, to deep dive into any problem areas, and to plan for the week ahead.

Team Leaders would also write very detailed written updates on the metrics that would be bubbled-up to the Regional General Manager and then COO levels.

My major lessons from this experience were:

You accomplish what you measure: When teams or individuals are focused on specific metrics, it can drive clear alignment and outcomes.

Written updates are very powerful: Clearly writing out on a weekly basis what you or your team accomplished and your goals for the next week creates a lot of transparency and also motivates people to improve on a WoW basis. Weekly reporting (ideally via email or Google Doc) also is one way that leaders can use to scale themselves and ensure they have proper visibility into what’s going on with each team & sub team. It’s hard to hide in the writing.

Transparent Dashboards

Uber had an incredibly transparent culture around data and metrics. There was an internal dashboard that included high-level and sub-metrics on a daily / weekly / monthly / yearly basis broken out by city and region so anyone could check in on how the company was doing. Everyone at the company also had access to a SQL database & system to run queries and perform their own analysis.

Data transparency is another way to drive alignment & trust across the organization.

Summary

Growth: If you have raised venture capital and/or your product is live with customers, you should be sure to focus on growth. If you’re a consumer company, measure growth & set goals on a Week-over-Week and Month-over-Month basis. For B2B companies, sales cycles can be longer, and you can still measure user metrics like Weekly or Monthly Active Users. GROW, GROW, GROW!

Top-Down Strategy: Having a clear top-down strategy aligns and motivates the entire organization. Simple & easy to remember is best.

OKRs: Once you have a clear strategy, sub-teams can create OKRs that support the broader company’s vision and goals. OKRs should be flexible and might change based on business needs. They should always be questioned and re-evaluated, if needed.

Monthly Business Reviews: Evaluating status of OKRs on a monthly basis is important for maintaining execution rates and flexibility.

Weekly Metrics Reviews: For Ops teams, weekly metrics review meetings help ensure everyone is aligned. Weekly written reports can add a lot of transparency for Leadership.

Transparent Dashboards: Providing the entire company access to transparent data can build trust and align all employees around key metrics.

Next Steps

Did you find this helpful? Do you have tips, tricks or Ops best practices you would like to share? Send me a note at allison@trailruncapital.com.